Our Clients

Lending is restricted to local authorities and public sector institutions in the Netherlands. As their partner we help to address social challenges regarding housing, education, healthcare, climate, energy and mobility on a large scale. This focus maximises the social impact of our activities.

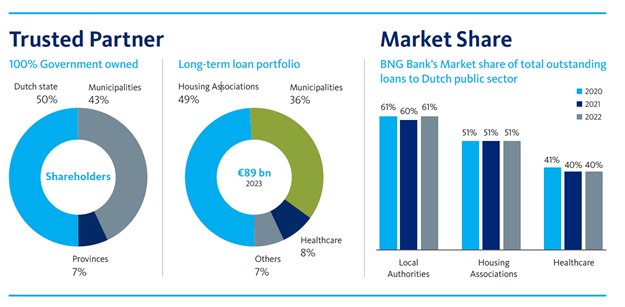

Market leader in the Netherlands with low credit risk exposure

Public domains in which we operate

Municipalities

Because of an effective system of legislation and regulation all Dutch municipalities are able to fulfil their financial obligations fully and at all times. The financial relationship between central and local government in The Netherlands is structured in such a way that the credit quality of Dutch municipalities is equal to that of the State of the Netherlands. The State of the Netherlands is rated Aaa by Moody's (stable outlook), AAA by Standard & Poor's (stable outlook) and AAA by Fitch (stable outlook). Dutch municipalities are not rated individually. Loans to Dutch municipalities are 0% risk weighted by the Dutch central bank.

Housing associations

Liabilities of housing associations are to a large extent supported by the Social Housing Guarantee Fund (“Waarborgfonds Sociale Woningbouw” (WSW)). This fund, ultimately backed by the municipalities and the State of the Netherlands, is rated Aaa by Moody′s and AAA by Standard & Poor's. Supervision of this sector is the responsibility of the Authority for Housing Corporations (“Autoriteit woningcorporaties” (Aw)). WSW guaranteed loans are 0% risk weighted by the Dutch central bank.

Healthcare institutions

Liabilities of healthcare institutions are in several cases secured by the Healthcare Guarantee Fund (“Waarborgfonds voor de Zorgsector” (WfZ)). This fund is ultimately backed by the State of the Netherlands and is rated AAA by Standard & Poor's. WfZ guaranteed loans are 0% risk weighted by the Dutch central bank.

Other

Recognized partner in advising on social challenges

BNG Bank is more to its clients than simply a provider of loans at favourable terms. We are recognized as a valued partner in addressing social challenges related to all our clients in the public space. We have extensive expertise and experience in advising the public sector in its move to a sustainable future.

For this we actively invest in our knowledge of clients and markets and engage with our clients to discuss their current and future needs, so that we can adjust our services accordingly. In situations where new policies, laws, or collaboration with government bodies, institutions, or other banks are necessary, BNG Bank has a wide-reaching network -even extending to the Dutch state- to address and advise on these challenges. By doing this, we help our clients and make sure to provide them the right products, through the right channels and at the right moment.

BNG Sustainability Fund

BNG Bank makes great impact by providing recourse financing to its clients and to help them make their assets more sustainable. In addition, there are many smaller project-based initiatives in the area of energy generation. Many of these have a limited need for financing. Within the regular procedures, it is difficult to provide this kind of financing in a cost-efficient manner and these projects often fall outside the scope of the bank’s strategic framework. For this reason, BNG Bank has set up the BNG Sustainability Fund (“BNG Duurzaamheidsfonds”) to finance business initiatives that contribute to the sustainability targets of municipalities and provinces. The BNG Sustainability Fund reports independently on its activities and its financial and non-financial results.